local services tax york pa

Pennsylvanias sales tax rate is 6. If the total LST rate enacted exceeds 1000 the tax will be deducted at a rate of 100 per week.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The tax is assessed on a pro rata basis ie the tax is divided by the number of annual payroll periods of the employer and is withheld each payroll period in which the individual is engaged in an occupation.

. Providing complete local tax collection services for Pennsylvania municipalities. The name of the tax is changed to the Local Services Tax LST. The Planning Commission is a great source for information such as building permit data census projections and more.

The Local Services Tax is an annual fee of 52 levied against all persons who are employed in York Township and who earned at least 12000 in a calendar year. Examples of business worksites include but are not limited to. The major tenants on this address are the Internal Revenue Service and United States Social Security Administration.

Local services tax rates CLICK HERE to obtain a table of the various Local Services Tax LST rates for York and Adams Counties. With over 25 years of experience in Accounting Tax Preparation Credit Repair and Debt Counseling Monarch Accounting Tax Financial Services has the 9. Employees can request an up-front exemption to the LST by submitting the appropriate paperwork to.

If the enacted LST rate exceeds 10 the tax must be withheld on a prorated basis determined by the number of pay periods established by an employer for a calendar year. For an appointment at the following sites if you are 50 years and older please call the York County Area Agency on Aging at 717-771-9042. Residents of York pay a flat city income tax of 100 on earned income in addition to the Pennsylvania income tax and the Federal income tax.

If the LST rate is 10 or less the tax may be. IRS Office York 2670 Industrial Highway York PA 17402. Contact pros today for free.

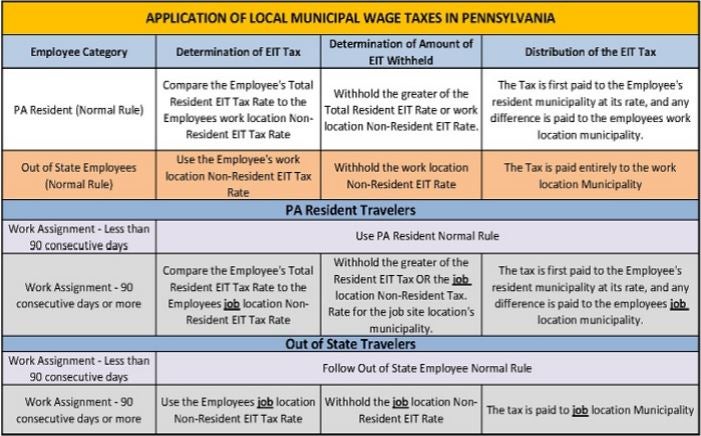

This tax is withheld based on employment location for both Pennsylvania residents and nonresidents working in Pennsylvania. If the area where you are employed levies the tax at a rate of 1000 the tax should be withheld from your first paycheck. If you need to connect with resources in your community but dont know where to look PA 211 is a great place to start.

Corporation Taxes - MORE -. The Bureau also collects Local Services Tax Delinquent. This is the date when the taxpayer is liable for the new tax rate.

Employees working in Pennsylvania are subject to the annual Local Services Tax LST. From help with a utilities bill to housing assistance after-school programs for kids and more you can dial 211 or text your zip code to 898-211 to talk with a resource specialist for free. LOCAL SERVICES TAX.

LST is also known as the head tax. It provides a wide variety of planning services and is primarily focused on the development of a countywide comprehensive plan. These funds are used to offset the cost of emergency services and are collected through payroll deductions and direct payment.

If the area where you are employed levies the tax at a rate of more than 1000 the tax should be withheld weekly or bi-weekly from your paychecks. Political subdivisions that levy an LST at a rate that exceeds 10 must exempt from the tax taxpayers whose total earned income and net profits from all sources within the. Ad Find affordable top-rated local pros instantly.

Trusted Professional Tax Collection Services Trusted Professional Tax Collection Services Trusted Professional Tax Collection Services. How and when is the tax deducted from my pay. He said New Jerseys sales tax rate in 2020 is 6625.

The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties. We are unaware of any. Sales Use and Hotel Occupancy.

There is no York income tax imposed on nonresidents who work in York although they may have to pay the resident local income tax in their own municipality. Trusted Professional Tax Collection Services. What is the Local Services Tax.

Local Services Tax is due to the area where you are physically working. See reviews photos directions phone numbers and more for the best Tax Return Preparation in York PA. Length of time are subject to the Local Services Tax.

Factories warehouses branches offices and residences of home-based employees. Motor and Alternative Fuel Tax. Enter through Door 8.

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Michael Hanscom Tax and Financial Services. It is due quarterly on a prorated basis determined by the number of pay periods for a calendar year.

Thursdays 830 AM 130 PM. The Local Services Tax shall be deducted for the municipality or school district in which you are employed. Pennsylvania has a single tax bracket of 307.

2530 Cape Horn Road Red Lion 17356. In New Jersey a single person with over 35000 in taxable income would be at the 35 tax rate he said. Living Word Community Church.

The rate of the tax is 5200 per year. Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local Services Tax LST on behalf of their employees working in PA. The York IRS Office is located by the Industrial Highway lesser populated than the rest of the city and kind of away from the dean and bustle.

The York County Planning Commission was formed in 1959 by the York County Board of County Commissioners. All residents of Adams County and all residents of York County except West Shore School District file their annual earned income tax returns with YATB. This tax is collected by the York Adams Tax.

Pennsylvania Department of Community Economic Development Governors Center for Local Government Services 400 North Street 4th Floor Harrisburg PA 17120-0235 Phone.

Missouri Income Tax Rate And Brackets H R Block

Tax Statement Form Seven Things You Should Do In Tax Statement Form Fillable Forms W2 Forms Excel Templates

If You Are A Small Business That Needs New Air Conditioning Equipment Check Out These New Tax Hvac Business Air Conditioning Equipment Small Business Expenses

Chart 3 Mississippi State And Local Tax Burden Vs Major Industry Fy 2016 Jpg Burden Educational Service Tax

Hvac Copper Fittings Hvac Leicester Hvac 7 8 To 3 4 Reducer Hvac Installation Basics Hvac Air Conditio Marketing Method Hvac Technician Hvac Training

Great Addition Tax Attorney Tax Lawyer Tax Refund

York Adams Tax Bureau Pennsylvania Municipal Taxes

Pennsylvania Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Car Donations Atlanta Car Donate Local Hospitals

Certified Comfort Experts Comfort York Peace Of Mind

C M Fuels Inc Designed And Developed By Webtek Static Ecommerce Responsive Development Website Redesign News Website Design Website Design Layout

State Local Tax Services Across Jurisdictions Bdo Tax

Blog Original Content By Client Full Width Layout Website Design Layout News Website Design Website Redesign

Leader Says City Promotes Tax And Spend Income Tax Tax Preparation Paying Taxes

Estate Tax In Bellflower Tax Services Estate Tax Bookkeeping Services

York Adams Tax Bureau Pennsylvania Municipal Taxes

Guide To Local Wage Tax Withholding For Pennsylvania Employers